UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or Section 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 13, 2023

FIFTH WALL ACQUISITION CORP. III

(Exact name of registrant as specified in its charter)

| Cayman Islands | 001-40415 | 98-1583957 | ||

| (State or other jurisdiction of incorporation or organization) |

(Commission File Number) |

(IRS Employer Identification Number) |

| 6060 Center Drive, 10th Floor Los Angeles, California |

90045 | |

| (Address of principal executive offices) | (Zip Code) |

(310) 853-8878

Registrant’s telephone number, including area code

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation to the registrant under any of the following provisions:

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading |

Name of each exchange on which registered | ||

| Class A Ordinary Shares, par value $0.0001 | FWAC | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01 | Regulation FD Disclosure. |

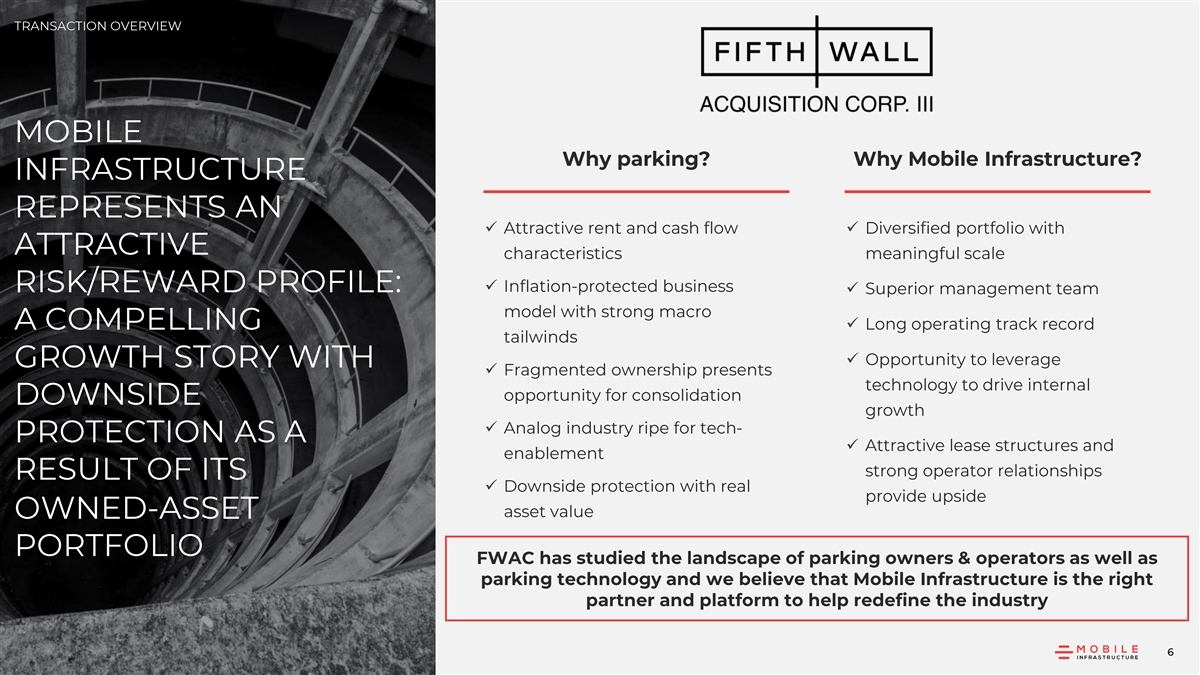

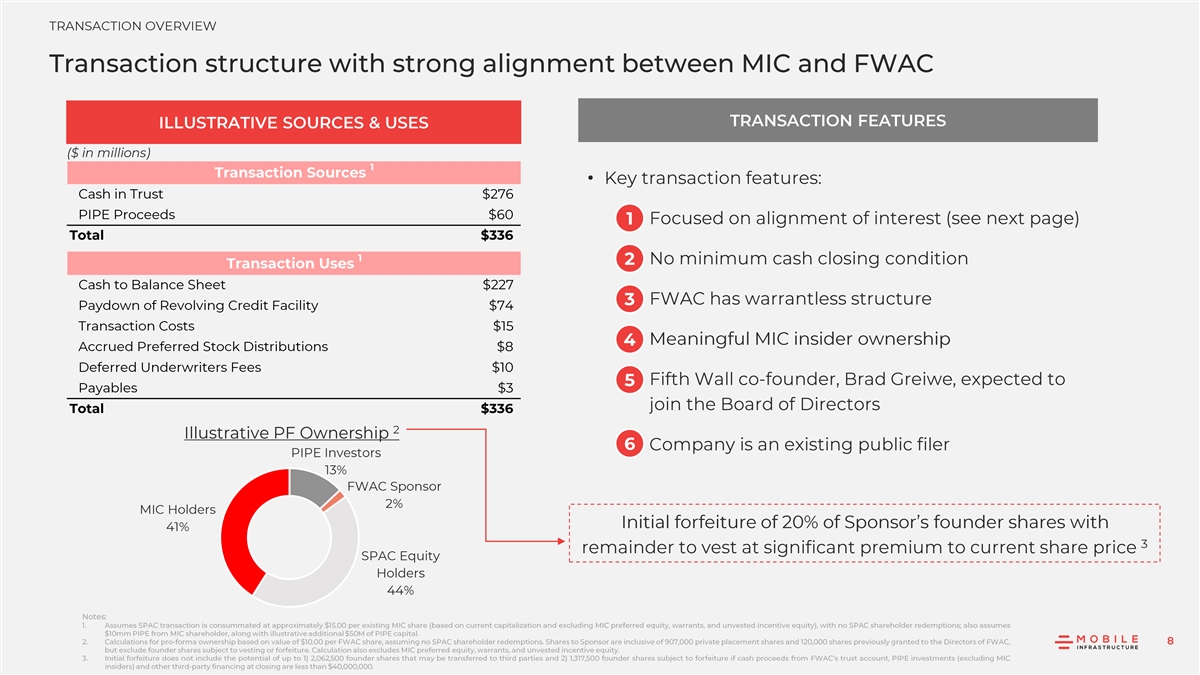

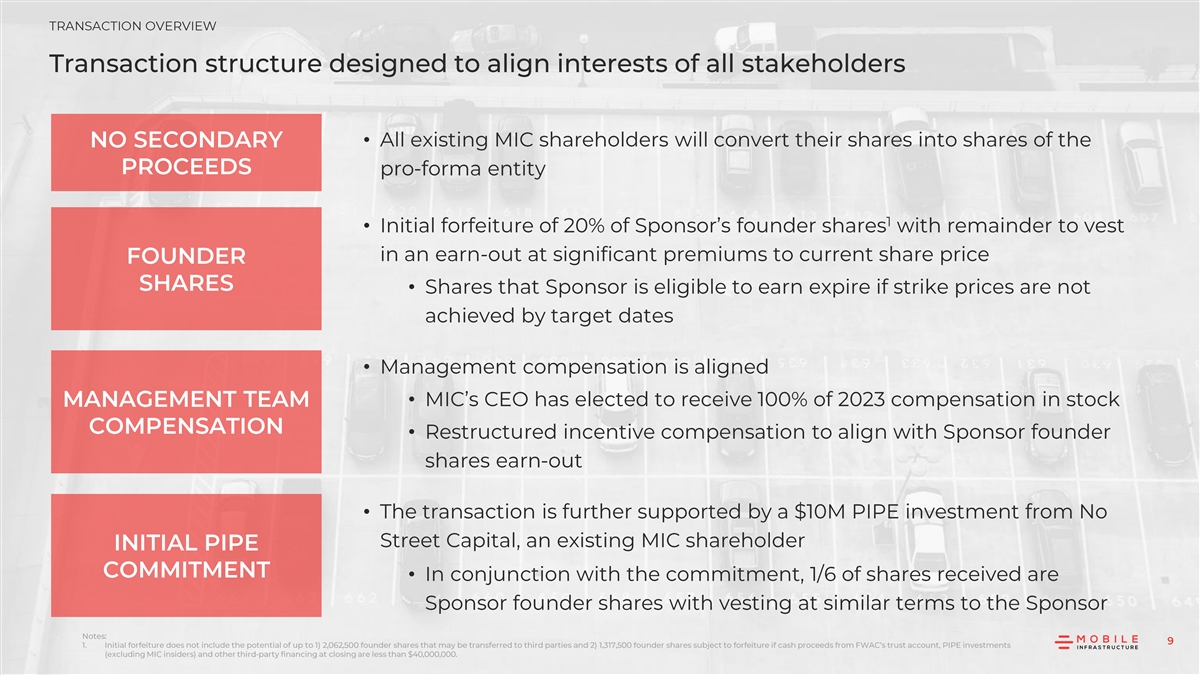

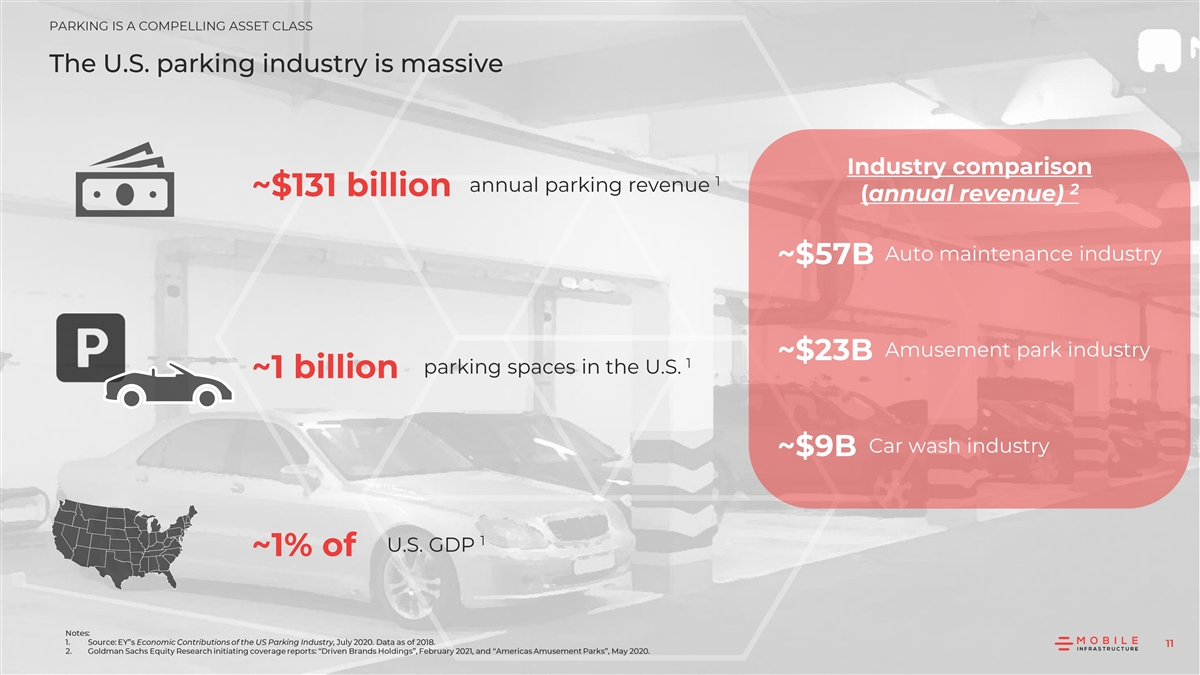

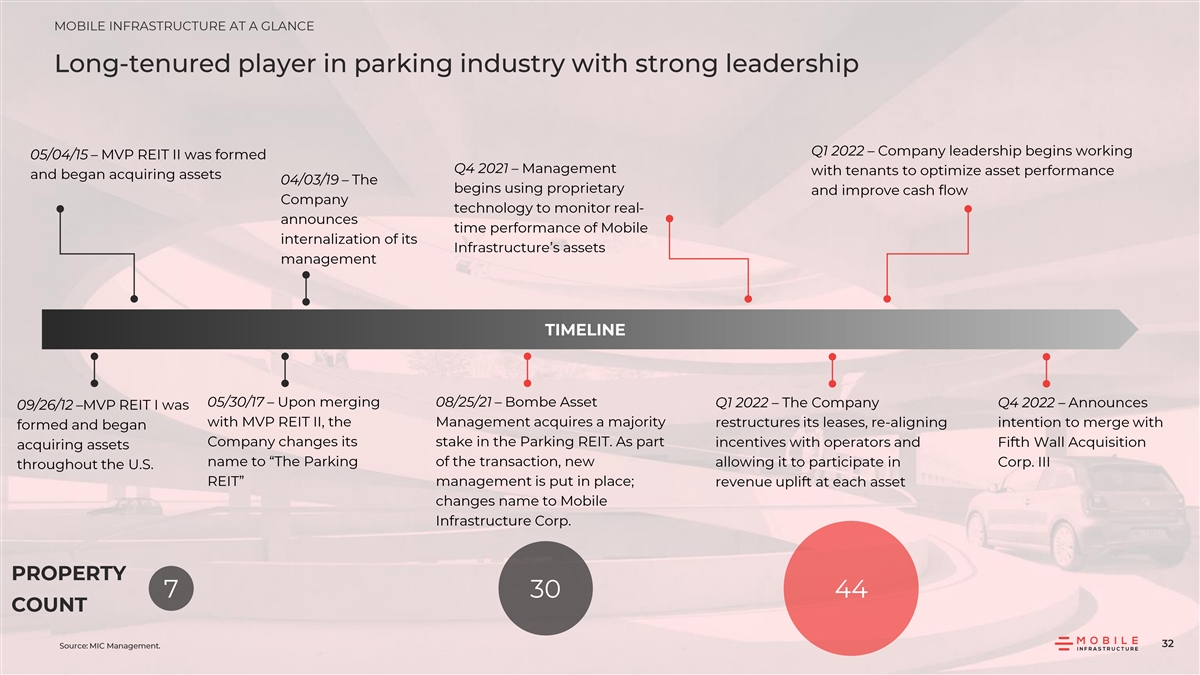

As previously disclosed, on December 13, 2022, Fifth Wall Acquisition Corp. III (“FWAC”) entered into an agreement and plan of merger (the “Merger Agreement”) with Mobile Infrastructure Corporation, a Maryland corporation (“MIC”), and Queen Merger Corp. I, a Maryland corporation and a wholly-owned subsidiary of FWAC.

Attached as Exhibit 99.1 is a presentation that MIC and FWAC plan to use in one or more meetings from time to time with potential investors. Exhibit 99.1 is incorporated by reference into this Item 7.01.

The foregoing (including the information presented in Exhibits 99.1) is being furnished pursuant to Item 7.01 and will not be deemed to be filed for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise be subject to the liabilities of that section, nor will it be deemed to be incorporated by reference in any filing under the Securities Act or the Exchange Act. The submission of the information set forth in this Item 7.01 shall not be deemed an admission as to the materiality of any information in this Item 7.01, including the information presented in Exhibit 99.1, that is provided solely in connection with Regulation FD.

Additional Information

This document relates to the transactions contemplated by the Merger Agreement (the “Proposed Transactions”). FWAC intends to file a registration statement on Form S-4 with the Securities and Exchange Commission (the “SEC”), which will include a joint proxy statement of FWAC and MIC and that will constitute a prospectus of FWAC, referred to as a Joint Proxy Statement/Prospectus, and each party will file other documents with the SEC regarding the Proposed Transactions. A definitive Joint Proxy Statement/Prospectus will also be sent to the shareholders of FWAC and the stockholders of MIC, in each case seeking any required approvals. Investors and security holders of FWAC and MIC are urged to carefully read the entire Joint Proxy Statement/Prospectus, when it becomes available, and any other relevant documents filed with the SEC, as well as any amendments or supplements to these documents, because they will contain important information about the proposed transaction. The documents filed by FWAC and MIC with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov. Alternatively, the documents filed by FWAC, when available, can be obtained free of charge from FWAC upon written request to Fifth Wall Acquisition Corp. III, 6060 Center Drive, 10th Floor, Los Angeles, California 90045, and the documents filed by MIC, when available, can be obtained free of charge from MIC upon written request to MIC, 30 W 4th Street, Cincinnati, Ohio 45202.

No Offer or Solicitation

This document does not constitute a solicitation of a proxy, consent, or authorization with respect to any securities or in respect of the Proposed Transactions. This document also does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor will there be any sale of any securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such other jurisdiction. No offering of securities will be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, or an exemption therefrom.

Participants in the Solicitation

FWAC, MIC and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies, in favor of the approval of the Proposed Transactions and related matters. Information regarding FWAC’s directors and executive officers is contained in the section of FWAC’s final IPO prospectus titled “Management”, which was filed with the SEC on May 26, 2021, and information regarding MIC’s directors and executive officers is contained in the section of MIC’s Annual Report on Form 10-K titled “Directors, Executive Officers and Corporate Governance”, which was filed with the SEC on March 30, 2022. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the Joint Proxy Statement/Prospectus and other relevant documents filed with the SEC when they become available. Free copies of these documents may be obtained as described in the paragraph titled “Additional Information.”

Forward-Looking Statements

This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 including, but not limited to, MIC’s and FWAC’s expectations or predictions of future financial or business performance or conditions, the anticipated benefits of the Proposed Transactions, the expected composition of the management team and board of directors following the transaction, the expected use of capital following the transaction, including MIC’s ability to accomplish the initiatives outlined above, the expected timing of the closing of the transaction and the expected cash balance of the combined company following the closing of the Proposed Transactions. Any forward-looking statements herein are based solely on the expectations or predictions of MIC or FWAC and do not express the expectations, predictions or opinions of Fifth Wall Asset Management, LLC, and Fifth Wall Ventures Management, LLC, their affiliates and any investment funds, investment vehicles or accounts managed or advised by any of the foregoing (collectively, “Fifth Wall”) in any way. Forward-looking statements are inherently subject to risks, uncertainties, and assumptions and any forward-looking statements contained in this document are provided for illustrative purposes and are not forecasts and may not reflect actual results. Such forward-looking statements are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Generally, statements that are not historical facts, including statements concerning possible or assumed future actions, business strategies, events, or results of operations, are forward-looking statements. These statements may be preceded by, followed by, or include the words “believes,” “estimates,” “expects,” “projects,” “predicts,” “forecasts,” “may,” “will,” “could,” “should,” “seeks,” “plans,” “scheduled,” “anticipates,” “potential,” “intends” or “continue” or similar expressions. Such forward-looking statements involve risks and uncertainties that may cause actual events, results, or performance to differ materially from those indicated by such statements. Certain of these risks are identified and discussed in the section of MIC’s Annual Report on Form 10-K titled “Risk Factors,” which was filed with the SEC on March 30, 2022, and in Part II, Item 1A “Risk Factors” in MIC’s Quarterly Reports on Form 10-Q filed with the SEC on

May 16, 2022, August 15, 2022, and November 18, 2022, and in the section of FWAC’s Form S-1 titled “Risk Factors,” which was filed with the SEC on April 16, 2021, as amended. These risk factors will be important to consider in determining future results and should be reviewed in their entirety. These forward-looking statements are based on MIC’s or FWAC’s management’s current expectations and beliefs, as well as a number of assumptions concerning future events. However, there can be no assurance that the events, results, or trends identified in these forward-looking statements will occur or be achieved. Forward-looking statements speak only as of the date they are made, and neither MIC nor FWAC is under any obligation and expressly disclaim any obligation, to update, alter or otherwise revise any forward-looking statement, whether as a result of new information, future events, or otherwise, except as required by law. Readers should carefully review the statements set forth in the reports, which MIC and FWAC have filed or will file from time to time with the SEC.

In addition to factors previously disclosed in MIC’s and FWAC’s reports filed with the SEC, including MIC’s and FWAC’s most recent reports on Form 8-K and all attachments thereto, which are available, free of charge, at the SEC’s website at www.sec.gov, and those identified elsewhere in this document, the following factors, among others, could cause actual results to differ materially from forward-looking statements or historical performance: risks and uncertainties related to the inability of the parties to successfully or timely consummate the Proposed Transactions, including the risk that any required regulatory approvals or securityholder approvals of MIC or FWAC are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the Proposed Transactions is not obtained, failure to realize the anticipated benefits of the Proposed Transactions, risks related to MIC’s ability to execute on its business strategy, attain its investment strategy or increase the value of its portfolio, act on its pipeline of acquisitions, attract and retain users, develop new offerings, enhance existing offerings, compete effectively, and manage growth and costs, the duration and global impact of COVID-19, the possibility that MIC or FWAC may be adversely affected by other economic, business and/or competitive factors, the number of redemption requests made by FWAC’s public shareholders, the ability of MIC and the combined company to leverage Fifth Wall’s affiliates and other commercial relationships to grow MIC’s customer base (which is not the subject of any legally binding obligation on the part of Fifth Wall or any of its partners or representatives), the ability of MIC and the combined company to leverage its relationship with any other Company investor (including investors in the proposed PIPE transaction) to grow MIC’s customer base, the ability of the combined company to meet NYSE’s listing standards (or the standards of any other securities exchange on which securities of the public entity are listed) following the Proposed Transactions, the inability to complete the private placement of FWAC common stock to certain institutional accredited investors, the risk that the announcement and consummation of the transaction disrupts MIC’s current plans and operations, costs related to the transaction, changes in applicable laws or regulations, the outcome of any legal proceedings that may be instituted against MIC, FWAC, or any of their respective directors or officers, following the announcement of the transaction, the ability of FWAC or the combined company to issue equity or equity-linked securities in connection with the Proposed Transactions or in the future, the failure to realize anticipated pro forma results and underlying assumptions, including with respect to estimated shareholder redemptions and purchase price and other adjustments; and those factors discussed in documents of MIC and FWAC filed, or to be filed, with the SEC. Additional factors that could cause actual results to differ materially from those expressed or implied in forward-looking statements will also be provided in the Joint Proxy Statement/Prospectus, when available.

Any financial projections in this document are forward-looking statements that are based on assumptions that are inherently subject to significant uncertainties and contingencies, many of which are beyond MIC’s and FWAC’s control. While all projections are necessarily speculative, MIC and FWAC believe that the preparation of prospective financial information involves increasingly higher levels of uncertainty the further out the projection extends from the date of preparation. The assumptions and estimates underlying the projected results are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the projections. The inclusion of projections in this document should not be regarded as an indication that MIC and FWAC, or their representatives, considered or consider the projections to be a reliable prediction of future events.

This document is not intended to be all-inclusive or to contain all the information that a person may desire in considering an investment in MIC and is not intended to form the basis of an investment decision in MIC. All subsequent written and oral forward-looking statements concerning MIC and FWAC, the Proposed Transactions, or other matters and attributable to MIC and FWAC or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above.

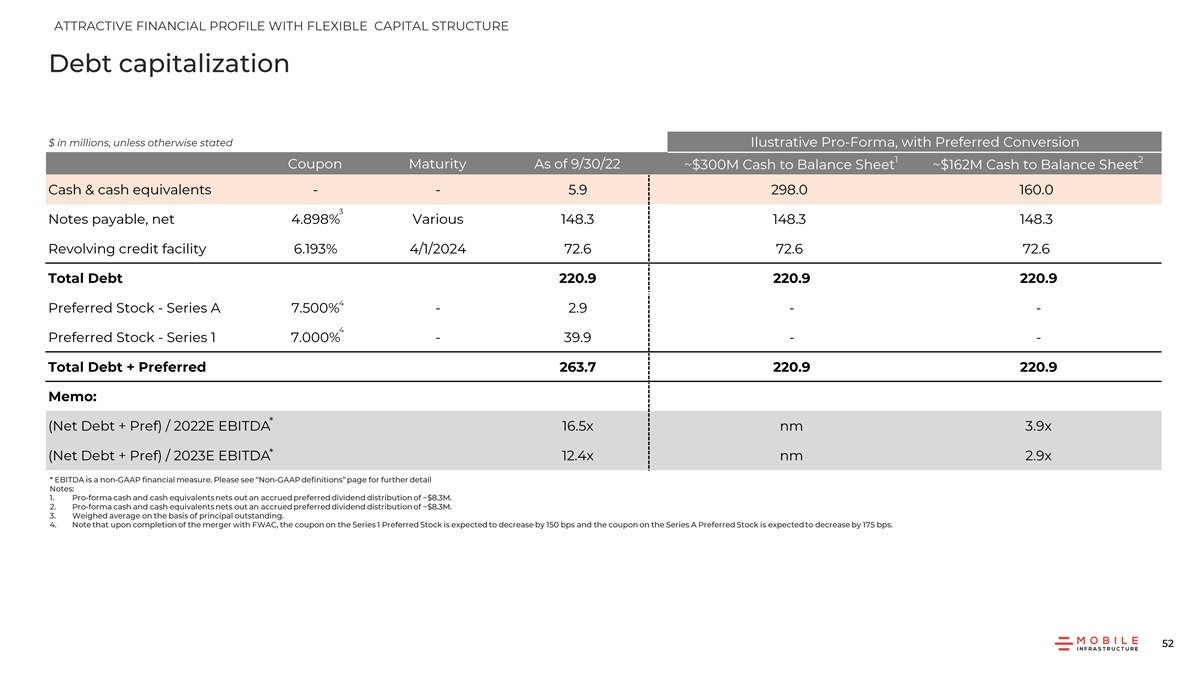

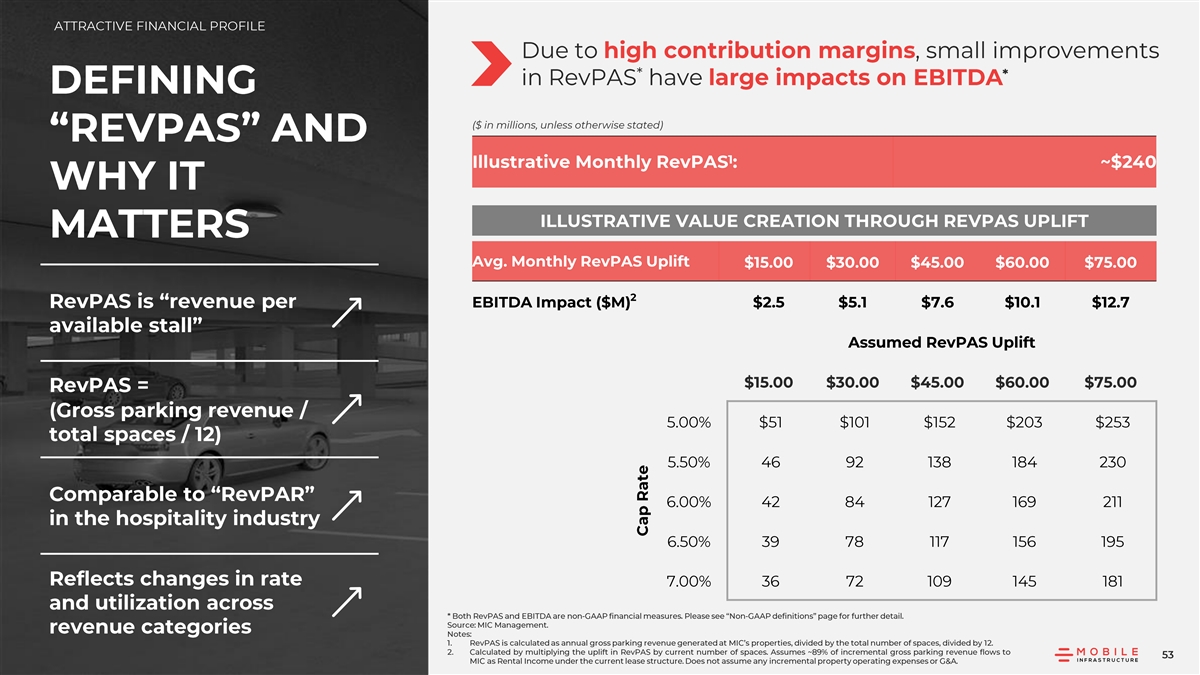

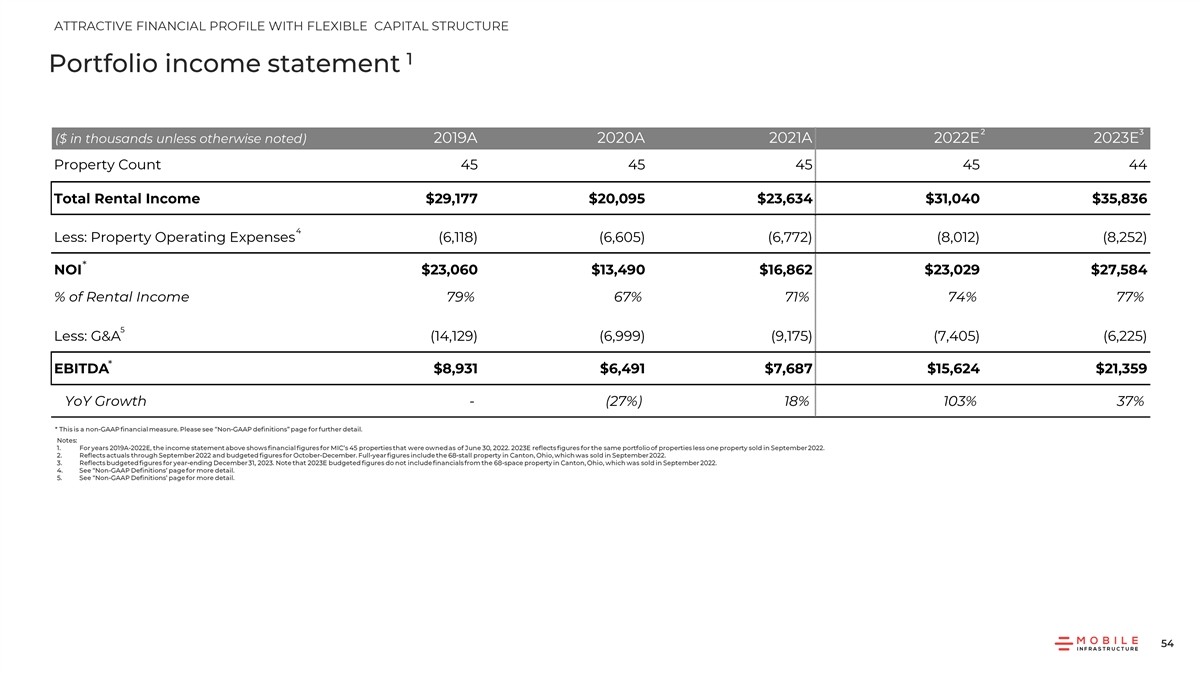

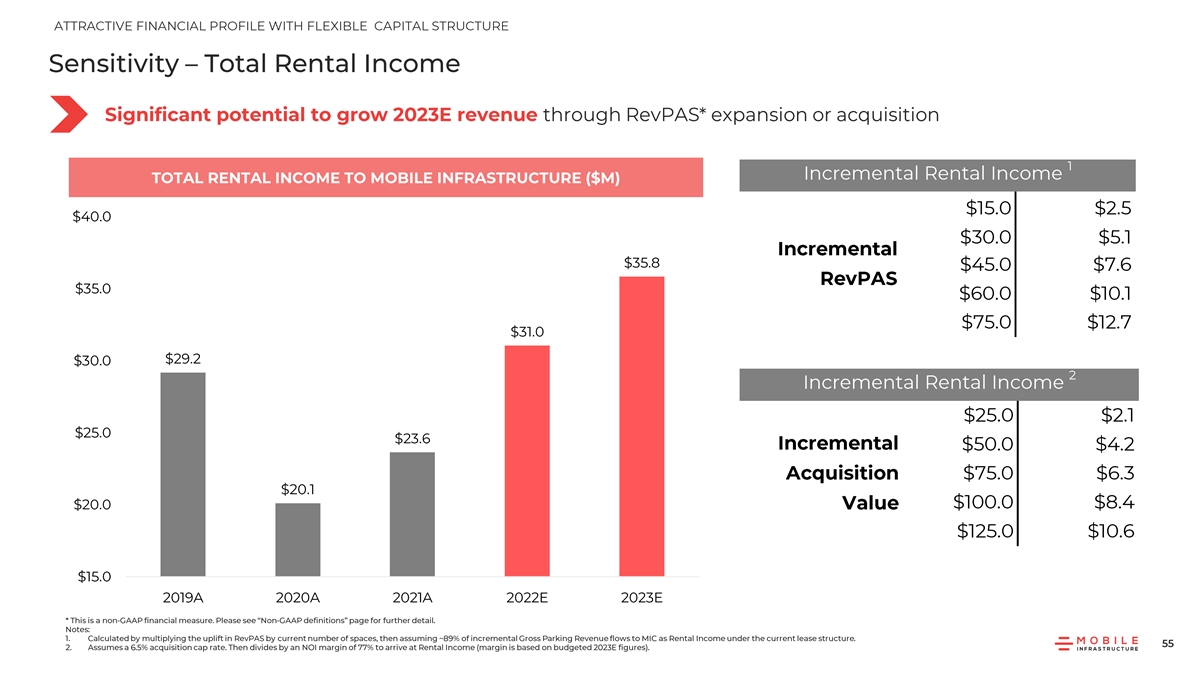

Non-GAAP Financial Measures

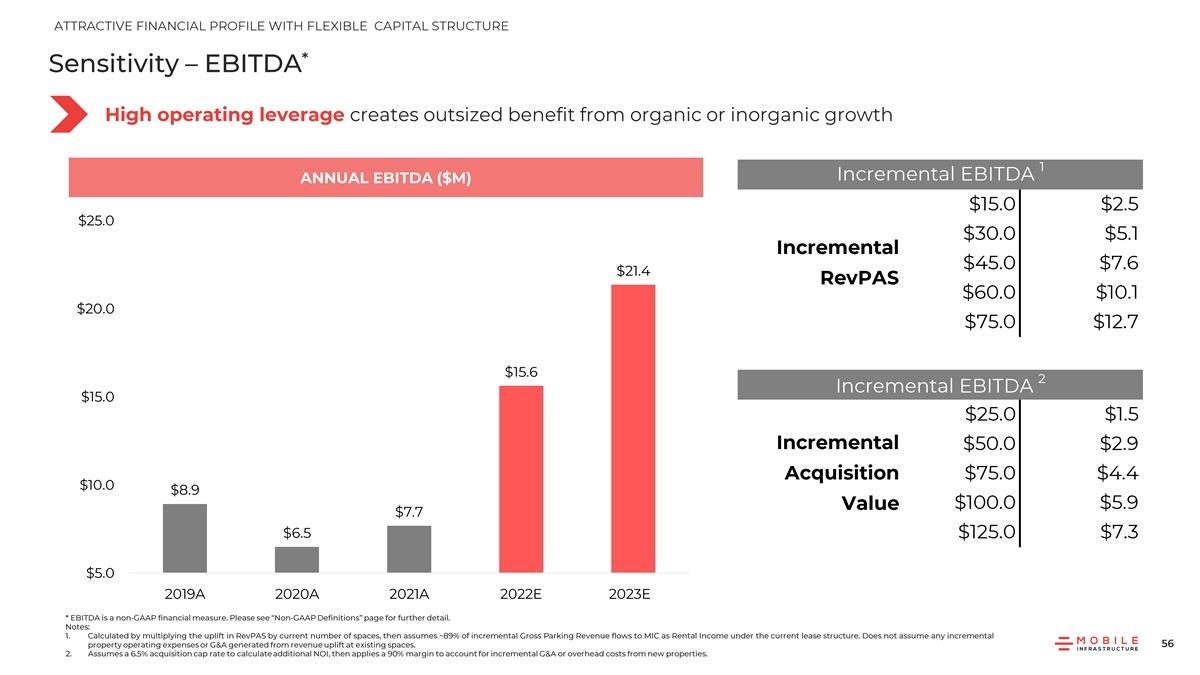

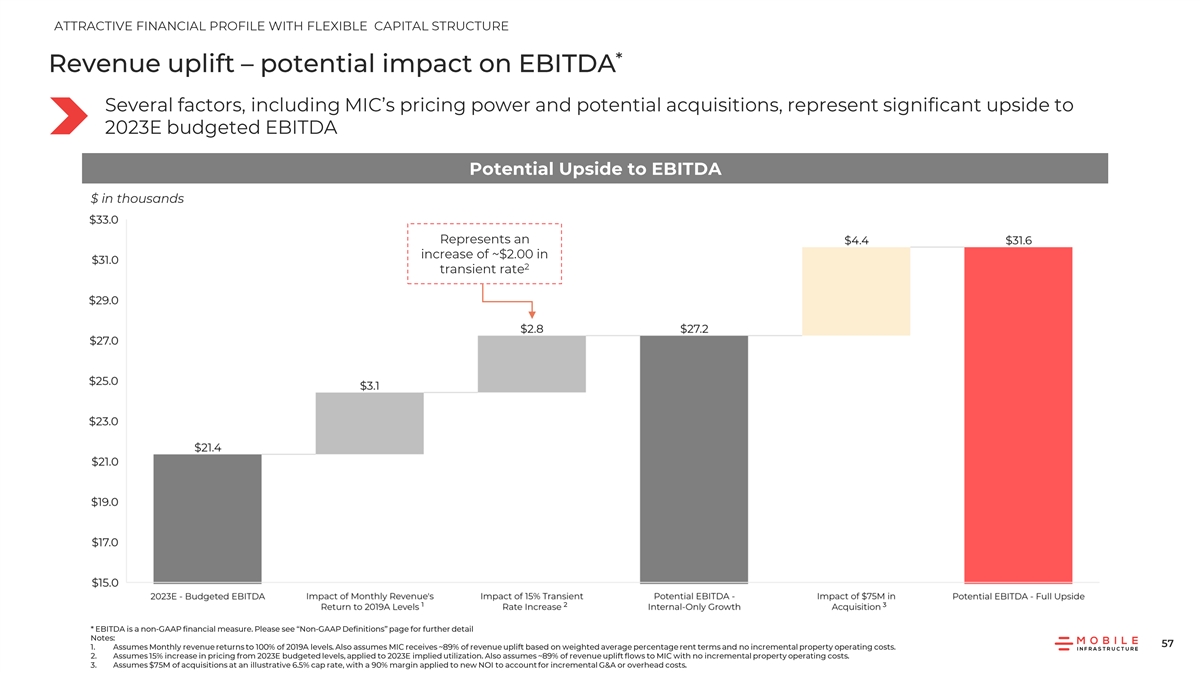

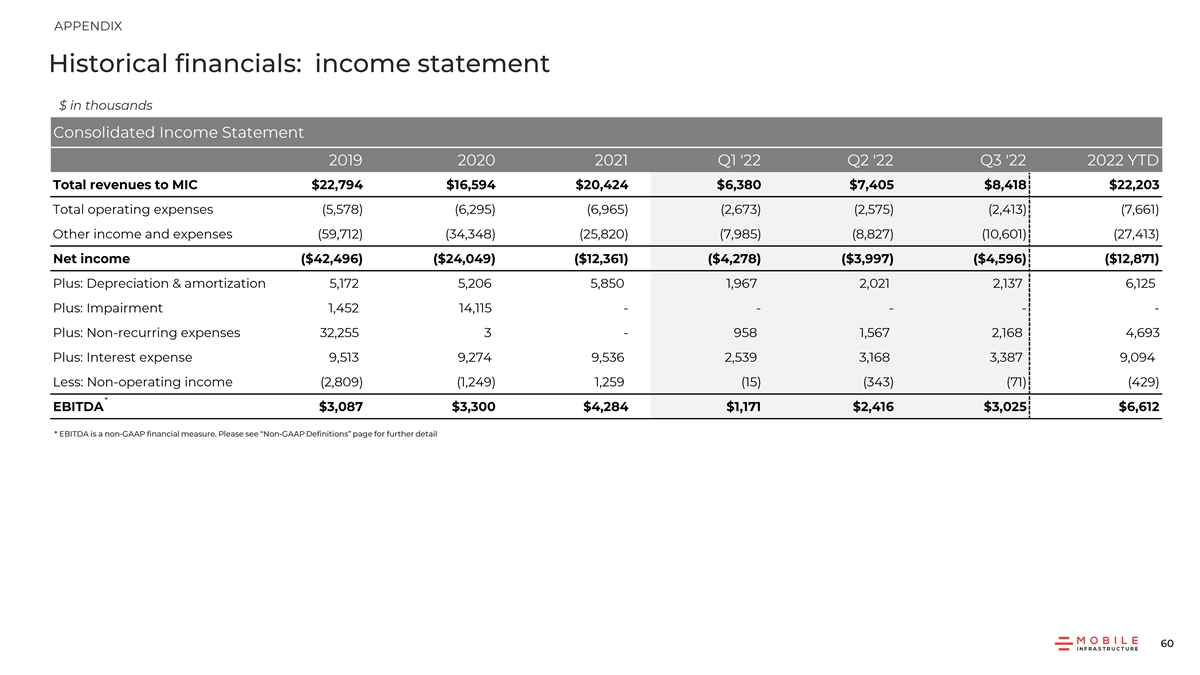

This document, and statements made in connection with this document, refer to non-GAAP financial measures, including EBITDA, property operating expenses, general and administrative expenses, net operating income, revenue per available space and unleveraged yield. These measures are not prepared in accordance with generally accepted accounting principles in the Unites States of America (“GAAP”) and have important limitations as analytical tools. Non-GAAP financial measures are supplemental, should only be used in conjunction with results presented in accordance with GAAP and should not be considered in isolation or as a substitute for such GAAP results.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

| Exhibit Number |

Description | |

| 99.1 | Investor Presentation, dated January 2023 | |

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL) | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: January 13, 2023

| FIFTH WALL ACQUISITION CORP. III | ||

| By: | /s/ Andriy Mykhaylovskyy | |

| Name: | Andriy Mykhaylovskyy | |

| Title: | Chief Financial Officer | |

Exhibit 99.1

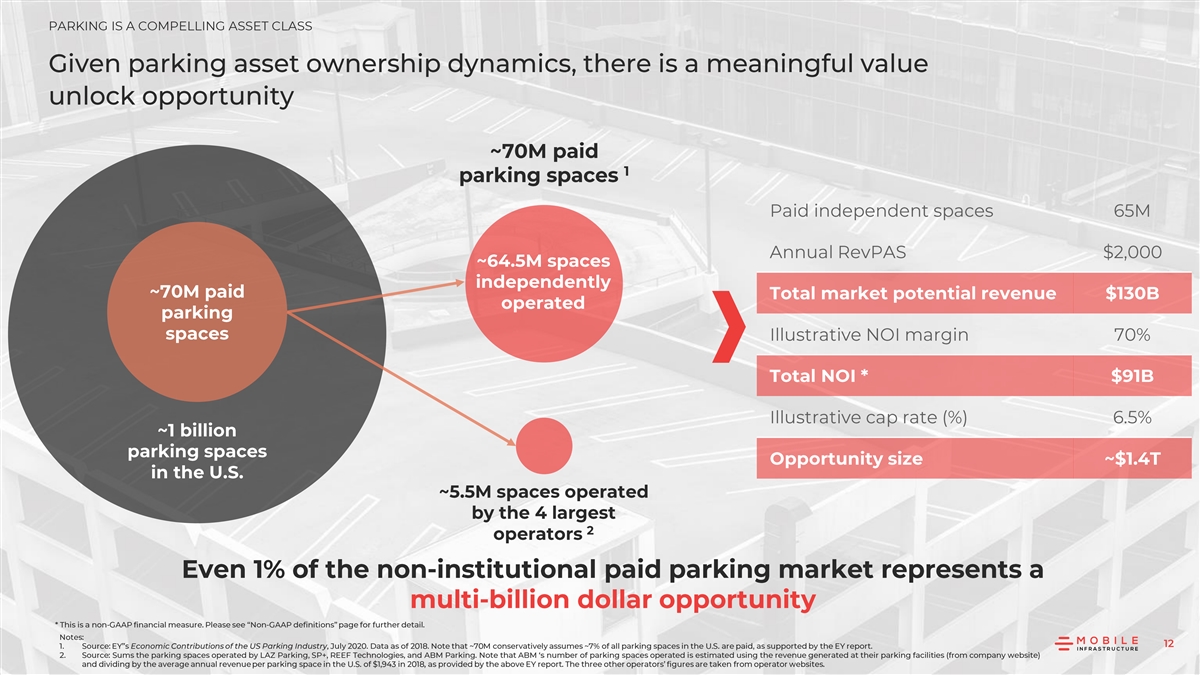

✓✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓

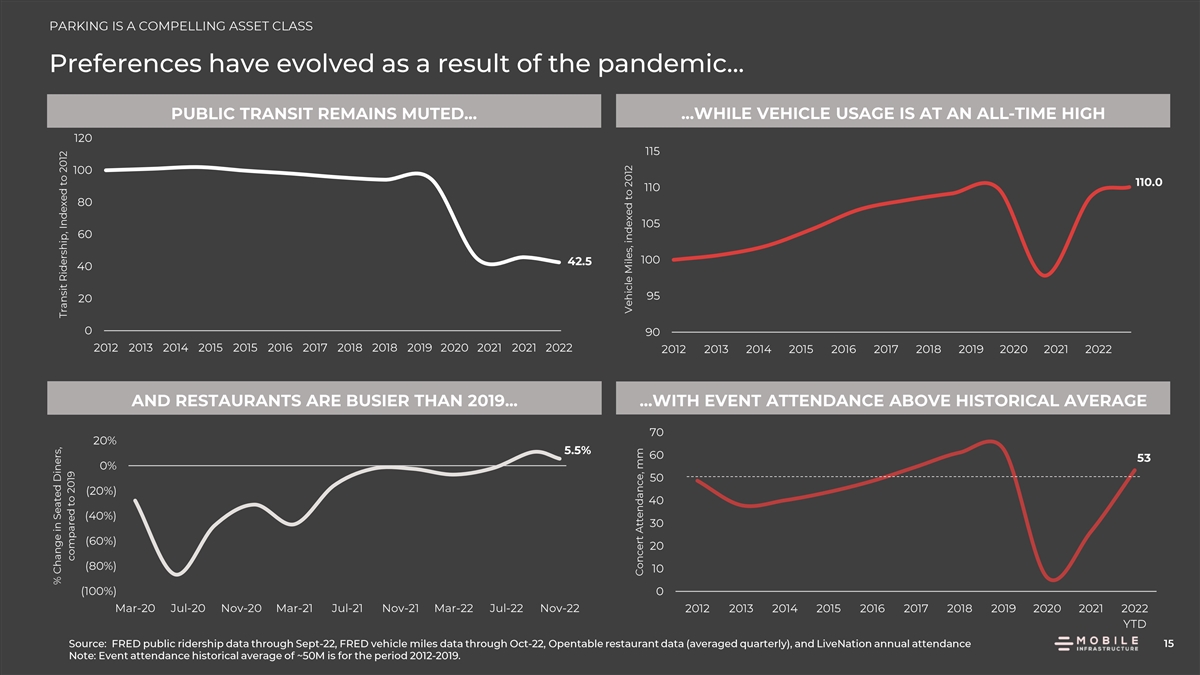

• • • • • • •

• • • • • • • •

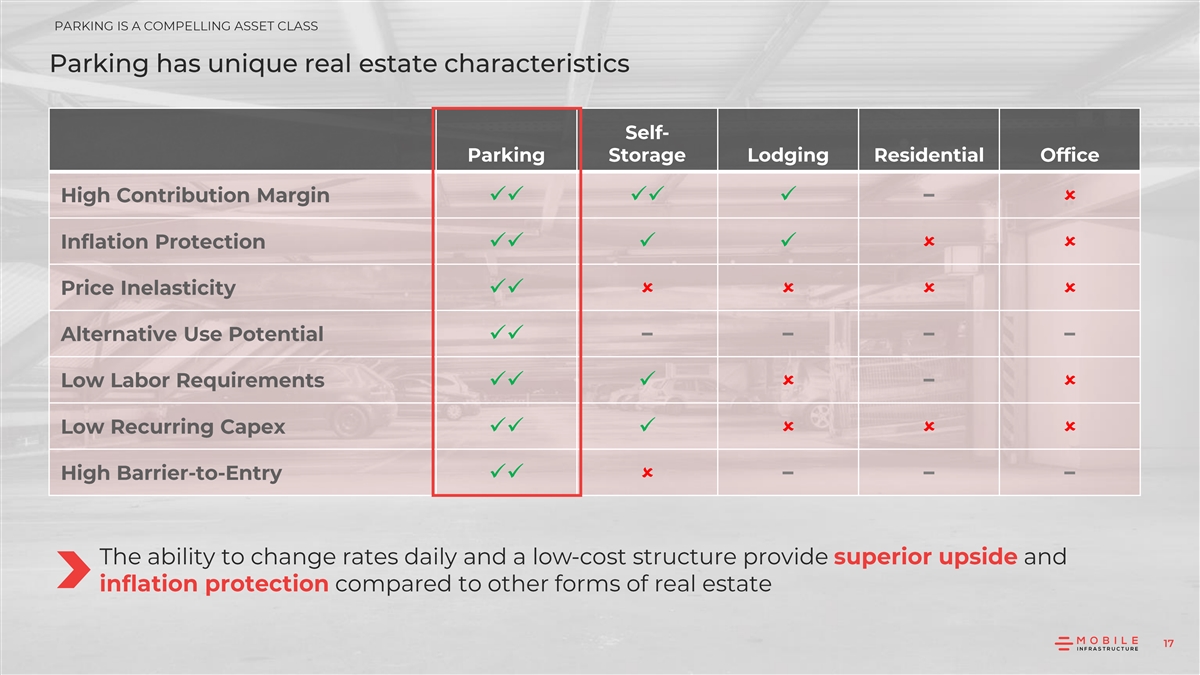

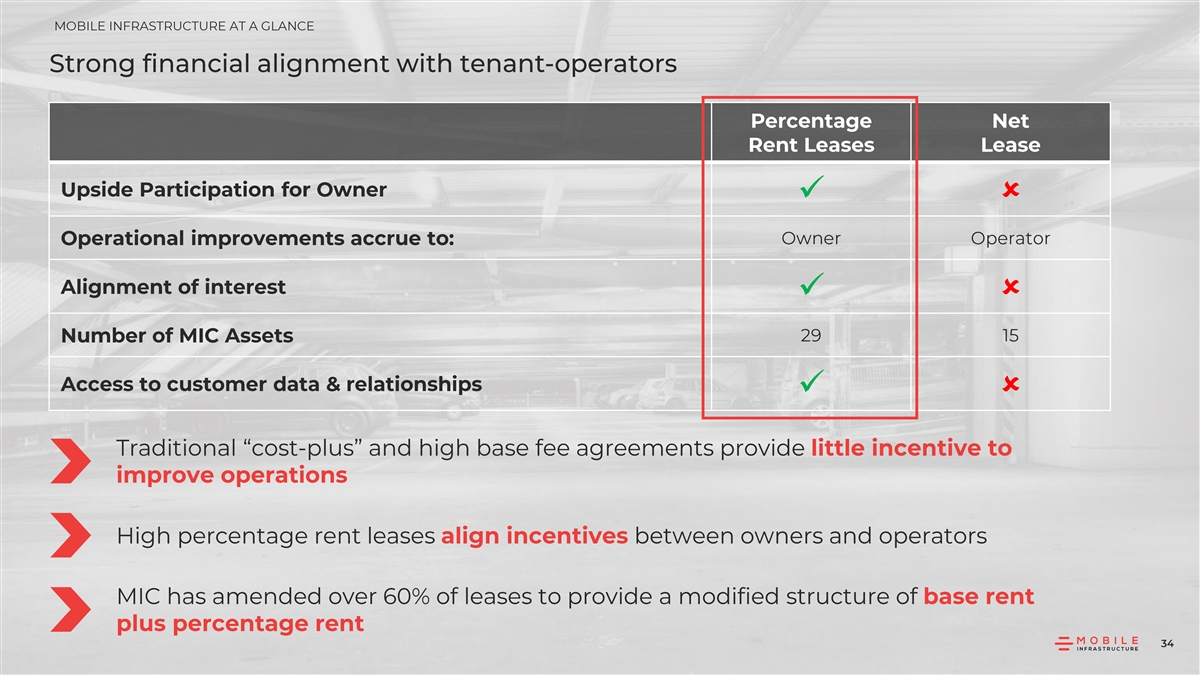

✓✓✓✓✓û ✓✓✓✓ûû ✓✓ûûûû ✓✓ ✓✓✓ûû ✓✓✓ûûû ✓✓û

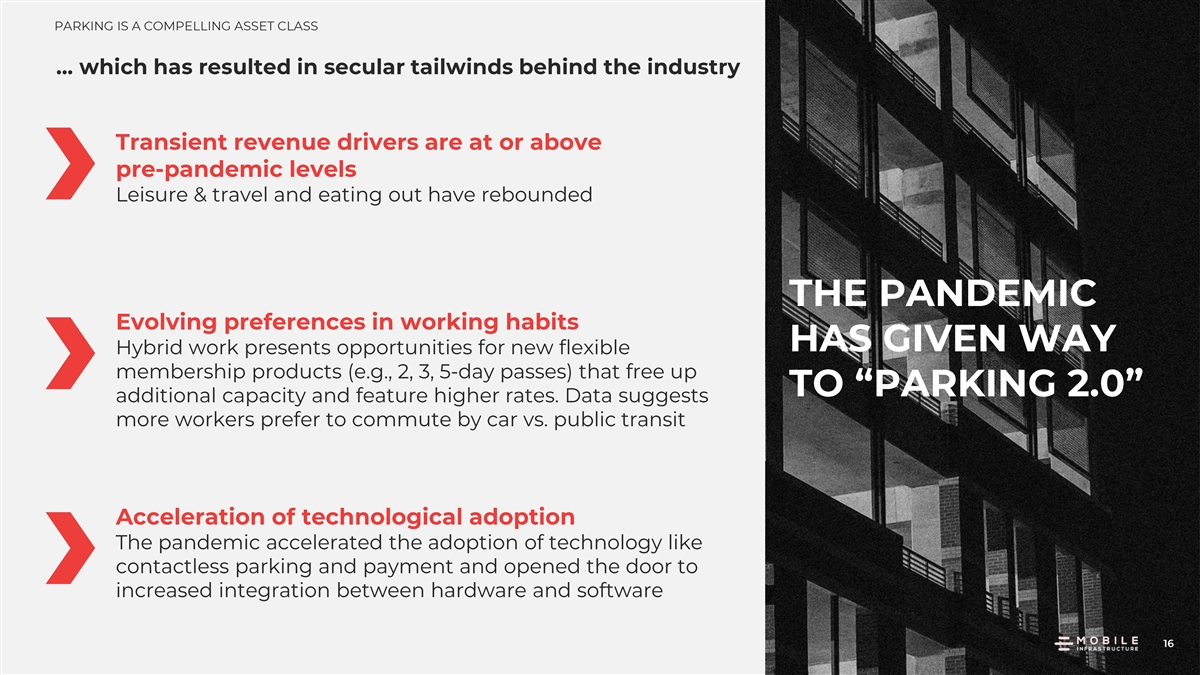

• • •

• •

•• • • • •• ••

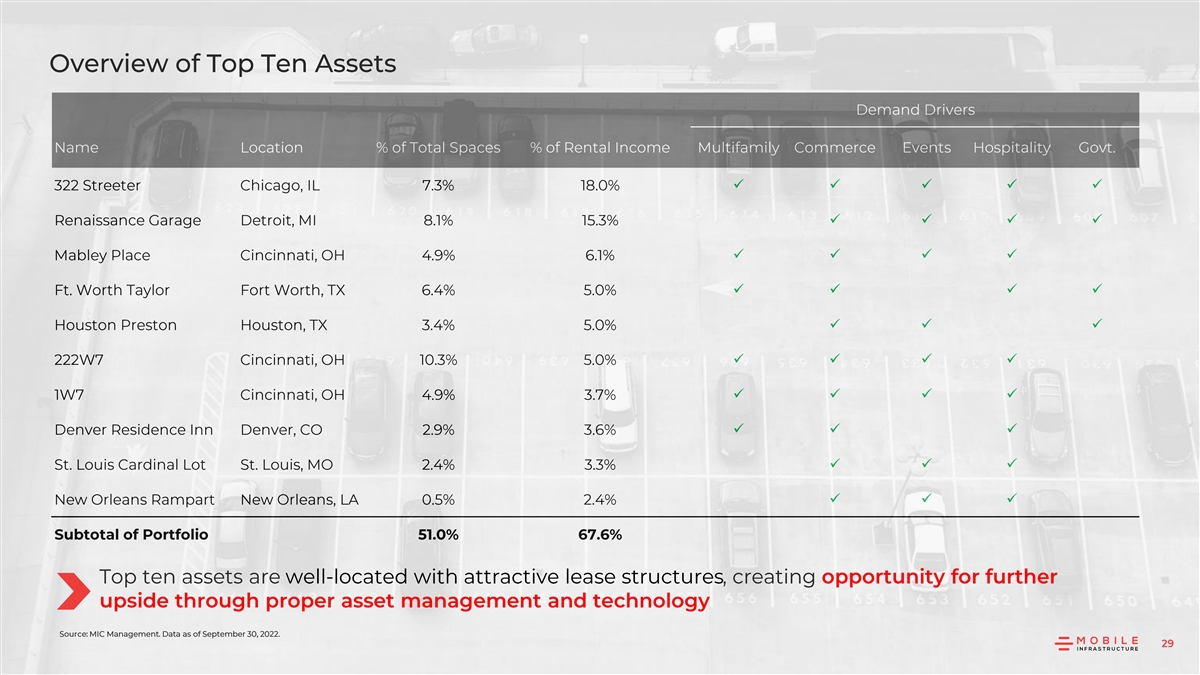

✓✓✓✓✓ ✓✓✓✓ ✓✓✓✓ ✓✓✓✓ ✓✓✓ ✓✓✓✓ ✓✓✓✓ ✓✓✓ ✓✓✓ ✓✓✓

•• •• •• o • • •

•• •• • •

✓û ✓û ✓û

• • • • • • • • • •

✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓

• • • •

• • • • • •

• • • • • •

• • • •